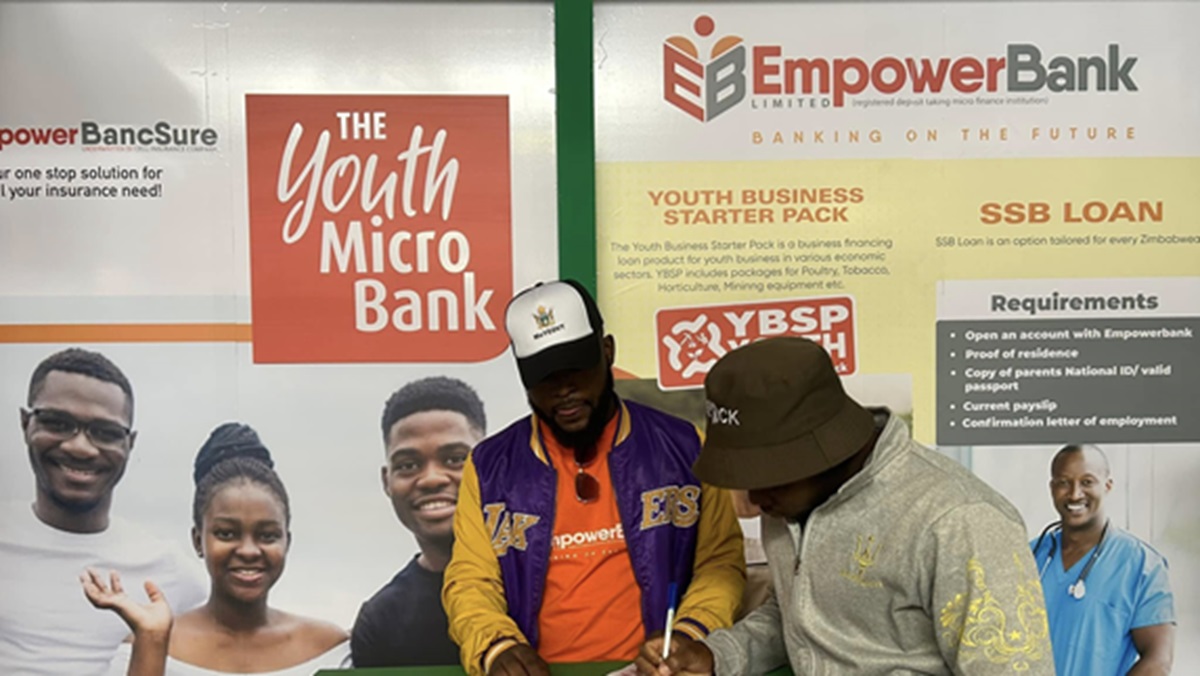

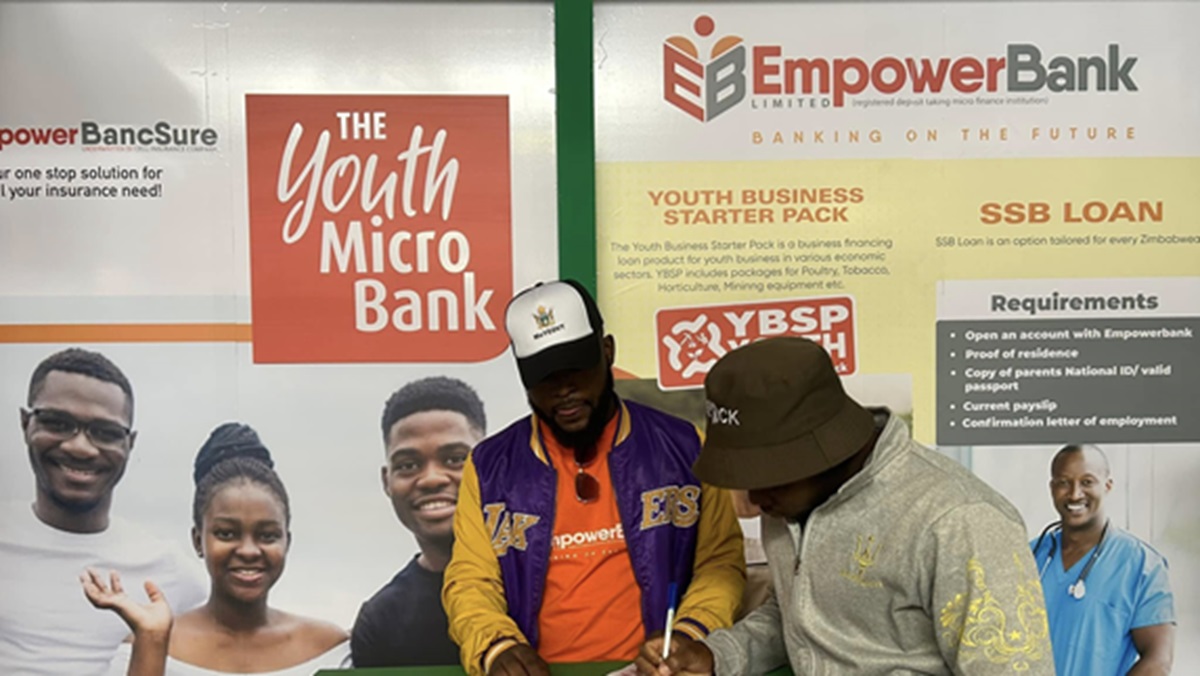

EmpowerBank, the microfinance bank launched with the promise of uplifting Zimbabwe’s youth entrepreneurs, is itself in desperate need of a lifeline. The Auditor-General’s 2024 report has revealed that the bank is operating with just a fraction of the required capital, placing it on a list of state enterprises whose very survival is in doubt.

The core function of a bank is to be a stable financial institution, but EmpowerBank is failing at this fundamental level. According to the report, the bank’s regulatory capital as of December 31, 2024, was a mere USD 983,389. This is alarmingly below the USD 5 million minimum capital requirement set by the Reserve Bank of Zimbabwe for deposit-taking microfinance institutions.

This critical shortfall led the Auditor-General to issue a stark warning, stating that this condition “indicates a material uncertainty that may cast significant doubt on the Microfinance Bank’s ability to continue as a going concern.” In simple terms, the bank created to empower the youth is at risk of failing, potentially taking the hopes and savings of its customers with it.

While management has pointed to a ZWG 150 million (USD 5.6 million equivalent) allocation in the 2025 National Budget as a potential solution, the report notes that so far, only a small portion of these funds have been released to the bank. This reliance on government handouts, which are often delayed or insufficient, highlights the bank’s unsustainable business model.

The report suggests that the bank’s mandate to empower “previously marginalized citizens” is being compromised by its own financial instability. Without adequate capital, EmpowerBank cannot provide the meaningful loans required to fund youth-led businesses, create jobs, or make a real impact on the economy. Instead of being a pillar of support for young entrepreneurs, it risks becoming a symbol of broken promises.

The AG’s findings raise serious questions about the viability of the institution. Was it launched without a clear path to sustainability? Are its operational costs too high, or is it failing to generate enough revenue from its lending activities? The report does not provide all the answers, but it makes it clear that the current situation is untenable.

For the thousands of young Zimbabweans looking for a financial partner to help them build their dreams, the news that EmpowerBank is struggling to stay afloat is a devastating blow. The AG’s report must serve as an urgent call to action for the government and the bank’s leadership. They must either find a way to properly capitalize the bank and put it on a path to sustainability or risk watching it fail, taking with it the aspirations of the very generation it was created to serve.